How To Save For A House

Saving your first house desposit can feel downright impossible. But I am going to show you (in 5 steps) how to save for a house deposit without taking 12 years and without growing broke.

I am not going to lie to you, saving a large sum of money is never easy. But with the right plan and a dedication to the end result it can be achievable.

Stay the path and before you know it you might just be living in the house of your dreams.

Why Most Advice On Saving Your Deposit Is Flat Out Wrong

Most advice I could find simply tells you to do a budget, cut back on all unnecessary spending until you have saved a house. (like this almost useless post)

I call this “eat canned beans” advice which comes from a dodgy property sales guy I once knew. His advice was to simply “eat canned beans” for an entire year until your house deposit is saved.

While cutting back on all unnecessary (everything from coffee’s to cable) makes logical sense, it often isn’t the best choice emotionally and doesn’t lead to solid savings.

What happens for most people is that they cut back on EVERYTHING and they save hard for a few months. Then they are so emotionally exhausted or depressed it only takes one bad thing (eg. Losing a job, not getting that promotion, relationship difficulties) and the saving plan goes out the window.

The $10,000 they worked so hard to save then gets spent on an expensive sofa or a 2 week trip to the Maldives to recover from all the stress saving has created.

Creating A Savings Plan That Works For You

This article is a walk through guide to help you create a savings plan that works for you.

Your savings plan might not look anything like my savings plan and that is OK. You might focus more on saving money, while I focus more on earning more money and that’s OK.

No single plan is going to be right for all people.

But if you take the time to read through this guide you will soon have a much better idea of your goals and how you are going to achieve them.

The 3 Things Needed To Effectively Save For A House

There are 3 things you need to effectively save for a house

1. A set target – You need to know exactly how much money you need to save. This is key to the next two steps, but most people skip over this. We will not permit “around $40,000”, we want to create an exact figure so we know without hesitation when we have achieved our target.

2. A deadline – If you want to stick with your savings plan long enough to buy a house (not just a sofa) then you are going to need a deadline as well. “12 months time” won’t cut it…because next month you are going to say “about 12 months time” again and your deadline will get stretched out. Set a firm date and stick to it. January 23rd next year is a better deadline than “X months time”.

3. A solid workable plan – The last thing you need is a way to get from A to B and that is your solid workable plan. It needs to be a flexible (but not too flexible) plan and it needs to be something that you can work with and achieve success.

Step 1: Know Exactly How Much You Need To Save (Setting The Target)

Most people think step 1 is to simply start saving. But saving with no real end goal feels meaningless and you won’t stick with it for very long.

Because of the level of sacrifice required to save your first home deposit you need to know exactly what you are striving for. If the destination is blurry then you will become disorientated on the way there.

A. Decide Ahead of Time What You Will Buy

We always want something one class above what we can afford. I know it is true.

Whenever my wife looked at rental properties I would always give her a budget (eg. $350/week). She would NEVER look at properties below $350/week (calling them disgusting) and would only look at properties from $350/week upwards.

Often she would look at the properties above the $400 price range. “If only we could spend $50 more per week look at what nice things we could have.”

When we moved outside of Sydney and were able to secure better properties for the same price I thought this habit would stop. But no it continued. Even though we were now living in properties that would have cost us $600 – $800 in Sydney my wife was still always looking at properties $50/week more than what we could afford.

It’s the way our emotions work and it’s not a bad thing. We are always striving for more. But sometimes this habit of wanting more than what we can afford stops us from growing towards our goal.

Decide ahead of time how much you want to spend on a property then research the market and find properties you would be happy to live in for that price.

If your price is $400,000 and you can’t find any properties in your chosen suburb for $400,000 then look at other suburbs or look at smaller properties.

Get to the point where you both agree on the price you want to pay for the type of house in the suburb you want to live.

Now you have set an important goal…the end price of your property.

B. Calculate Your Required Deposit

Now that you have decided on the price on the property you need to calculate your required deposit.

You may want to save a 20% deposit or you may be happy with just a 5% deposit. But regardless you need to decide exactly what deposit you want to save.

A 20% deposit on a $400,000 house is $80,000. A 5% deposit is only going to be $20,000…much more achievable for most people.

Most people avoid lower deposits because you have to pay Lender’s Mortgage Insurance. However, it most cases this can be added to the loan and may only cost you an extra $10/week in mortgage repayments.

Use our house deposit calculator if you need help doing the calculations. This nifty tool will do the calculations for you.

You should now have a dollar figure on the amount of deposit you need. But we aren’t finished target setting yet.

C. Add On Property Closing Costs

Most people forget entirely about property closing costs. But the fact it you need to take them into account and save for them (unless you are getting government concessions).

Your major closing costs are:

Stamp Duty – Stamp duty is very hard to calculate because it isn’t a set amount and varies from state to state. A simple formula is to estimate it at 4% of the purchase price of the property. This gives a rough idea but is not entirely accurate. Use this stamp duty calculator to calculate what your stamp duty will be based on the price set in 1.A.

Solicitor/Conveyancer Fees – You will need to pay a solicitor or conveyancer to draw up contracts and help you with the sale of your property. These fees range wider from around $1,000 to over $3,000+

Building and Pest Inspections – At around $300 each these will help you discover any major flaws with the property before purchasing.

Valuation – Unless you get your valuation for free a property valuation can be costly. Ranging anywhere from $300-$600 in metro areas to even more expensive in rural areas. This needs to be done to secure your loan.

Mortgage Fees – Mortgage fees vary from lender to lender. Some mortgage fees are extremely low whilst other lenders charge anywhere from a few hundred to over one thousand dollars.

Costs tend to range from between 4-6% of the purchase price of a property. It is important that you work out these costs as you will almost certainly have to pay for most of these out of your own pocket.

D. Add It All Together

You now need to add the value of your deposit required with total cost of your out of pocket expenses.

This will give you your savings requirement.

You now have a dollar figure that you should be saving towards.

It might be $20,000, it might be $50,000…whatever it is.

Set your saving goal amount in stone as much as possible.

Step 2: Create A Deadline and Required Savings Plan

The next mistake most people make when deciding how they will save for a house is that they don’t create a deadline.

Even if they go to the effort of setting a savings target of say “$50,000” they don’t set a deadline.

A. Set Your Savings Deadline

While a deadline of “A.S.A.P” may sound great it rarely leads to good results, and a deadline of “12 months” is only slightly better.

What is most effective is setting a deadline date “13th March next year” or “21st November in 2 years”

When you say “12 months” that often expands out and the 12 months never becomes 11 months and you never reach your goal. However, by creating a date you have something concrete that you are working towards.

B. Work Out How Much You Need To Save

Now that you have a date and a target amount you can work backwards to find out how much you need to save each month, week and day to achieve your target.

I recommend using the saving my house deposit calculator to work out exactly how much you will need to save on a regular basis to achieve your target.

C. Do A Budget

In order to create your savings plan you need to create a budget and estimate how much you think you will be able to afford to save.

I recommend you complete steps C and D together. Creating the right budget is about balancing your savings plan with your living expenses. Doing a living expense budget without savings in mind will lead you to spend excessively. Doing a saving plan without a liveable budget will cause you to create unrealistic expectations.

There are a lot of great articles out there on creating a budget so I won’t go into detail here. Check out the budget advice from ASIC as a good place to start.

D. Create Your Savings Plan

Using the calculator mentions above you may come to realise that you need to save $2,000/month in order to save your deposit in your allotted time frame.

Don’t stop and let that be your plan. Make it more concrete.

If you get paid once per month on the 21st of each month make your saving plan sound like this

We will put $2,000 into our savings account on the 21st of each month for the next 24 months. Final payment will be made on 21st March 20XX.

Make it as crystal clear as possible

Step 3: Save

Your next step is to begin the savings journey. There are two ways to approach saving.

Both are difficult, but the first option tends to yield better results for most people

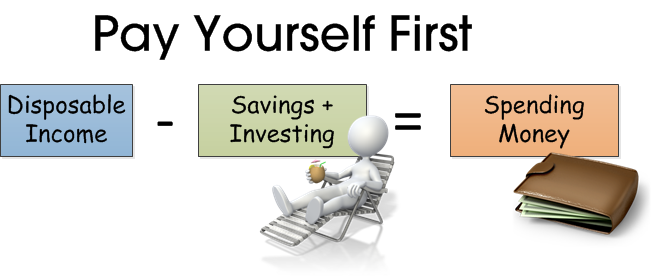

A) Pay Your Savings First and Live Off The Rest

This tends to be the most effective way to save for most people. The idea is that before you pay for anything at all you pay money into your savings.

That means on payday the first expense you pay is your “savings expense”.

You then seek to live off the rest of the money.

So if you earn $5,000/month (after tax) and you want to save $2,000 per month then on pay day you put $2,000 into your savings account.

You now have $3,000/month left to pay rent and other living expenses. You cannot touch the $2,000 already saved…consider it gone.

By choosing to save first and live off the remainder you tap into human creativity and make it your asset.

Just as if you ran out of money in everyday life you would use your creativity to find more money the same applies when saving.

By reducing your discretionary budget your mind will work out creative ways to live happily off the amount you give yourself (or find ways to earn more money).

We cover spending less and earning more in more detail in Step 4 and Step 5

B) Live Your Life and Save What Is Left Over

The second (less successful) option is to try and live as tightly as possible and then save whatever money is left over at the end of the month.

You goal may still be the same (eg. try and save $2,000/month) but the chances are some expense will come up each month that you didn’t expect. You might have to pay for flights interstate for a family event, you might have an expensive electricity bill, you might really need those front row Miley Cyrus tickets that cost $300 each.

By living first and saving last the chances are that you will not have enough money left at the end of the month to save due to unexpected expense aka “expense creep”.

Other Savings Tips

Consolidate Your Savings Into One Account – By consolidating your savings into one account (preferably interest bearing) you can start to see the value of your savings grow over time. This offers maximum emotional reward for your savings effort.

Put Your Money Somewhere You Cannot Touch – With money accessible with just the click of a button a separate savings account probably won’t do the trick. Consider an account with a separate bank (out of sight out of mind). You can also obtain accounts where you cannot access your money without going to the bank and signing documentation or the First Home Savers Account can be great because you legally can’t obtain the money except in emergencies.

Step 4: Spend Less

Whether you chose to pay your savings first or to live first spending less will be a vital skill you need to learn in order to remain emotionally content with your life while saving.

This is NOT about being a martyr and giving up every little luxury in life, this is about being smart with your money and stretching your dollar further.

I will offer snapshots of savings advice here. For more in depth tips and advice read/view how to save your home deposit fast by spending less money

50 Tips For Spending Less So You Can Save Your House Deposit Faster

- Buy Cheaper Brands Where It Doesn’t Matter

- Sell Or Downgrade Your Car

- Shop at Aldi, Cosco or Other Discount Stores

- Rent Somewhere Cheaper

- Move Back In With The Family

- Cut Back On The Lattes (or just have them at home)

- Take A Clever Holiday

- Create a Daily Budget

- Only Buy What You Can Carry

- Shop With Friends

- Go Bargain Hunting in Op Shops or $1 Stores

- Use Credit Cards The Right Way

- Track Your Spending

- The Envelope System

- Snowball Your Debt

- Consolidate Your Debt

- Save on Utilities and Insurance

- Cancel Cable and Watch Online

- Make It A Game

- Turn Off The Lights

- Turn Off The Heater

- Use A $10 Fan (and maybe some ice) Instead Of Air-Con

- Dry Clothes On The Line – Not In The Dryer

- Turn Devices Off, Don’t Leave Them On Standby

- Buy In Season

- Plan Your Meals Each Week And Stick To A Shopping List

- Make Take Away Food At Home

- Carry Snacks With You

- Make Your Own Lunch

- Drink Cheaper Wine

- Carry a Bottle of Water Everywhere

- When Eating Out Just Get Mains

- Visit BYO Restaurants

- Drink More Water

- Drink Less Alcohol

- Avoid Late Fees

- Pay Bills On Time To Get A Discount

- Say GoodBye To Monthly Bank Fees

- Cancel All Membership Possible

- Get Rid Of Your Home Phone

- Get Cheaper Home Internet, Or Use You Mobile Phone’s Wi-Fi

- Pre-Paid, Not Post-Paid

- Make YouTube Your Friend

- Don’t Buy Anything Until You Have Checked The Online Price

- Buy The Clothes You Need And Make Them Last Longer

- Attend Free Local Events

- Take Public Transport or Ride Your Bike

- Go Out Mid-Week Rather Than On Weekends

- Agree Not To Buy Expensive Gifts For People Ahead Of Time

- Keep Your Goal Front Of Mind

Step 5: Earn More

I love the idea of setting a savings target that is affordable and achievable and then working hard to earn more money to make your life more fun whilst saving.

The less emotional strain you put on yourself during the saving period the less likely you are to relapse and spend extravagantly and waste your savings.

However, some people may also be interested in earning more money so that they can save a larger deposit or save their deposit faster.

I will offer snapshots of savings advice here. For more in depth tips and advice read/view how to save your property deposit quickly by earning more money

10 Ways To Save Your Deposit Faster By Earning More Money

- Rent Out A Room

- Rent Out Your Garage

- Sell Your Stuff

- Get A Second Job

- Start A Side Business

- Make Some Money Online

- Earn Interest On Your Savings

- Earn Commissions and Save Them

- Clever Credit Transfers

- Maximise Your Tax Returns

How To Save For A House: In Review

So in review here is how to save for a house – step by step – simply laid out

Step 1: Set A Target

Step 2: Decide On A Deadline

Step 3: Start Saving

Step 4: Spend Less

Step 5: Earn More

DISCLAIMER No Legal, Financial & Taxation Advice

The Listener, Reader or Viewer acknowledges and agrees that:

- Any information provided by us is provided as general information and for general information purposes only;

- We have not taken the Listener, Reader or Viewers personal and financial circumstances into account when providing information;

- We must not and have not provided legal, financial or taxation advice to the Listener, Reader or Viewer;

- The information provided must be verified by the Listener, Reader or Viewer prior to the Listener, Reader or Viewer acting or relying on the information by an independent professional advisor including a legal, financial, taxation advisor and the Listener, Reader or Viewers accountant;

- The information may not be suitable or applicable to the Listener, Reader or Viewer's individual circumstances;

- We do not hold an Australian Financial Services Licence as defined by section 9 of the Corporations Act 2001 (Cth) and we are not authorised to provide financial services to the Listener, Reader or Viewer, and we have not provided financial services to the Listener, Reader or Viewer.

"This property investment strategy is so simple it actually works"

Want to achieve baseline financial freedom and security through investing in property? Want a low risk, straightforward way to do it? Join more than 20,000 investors who have transformed the way they invest in property."