How Does Equity Work? The Dummies Guide To Equity

Equity is a complicated topic. People discuss owners equity, available equity, equity loans and a bunch of other things that relate to using equity.

For the average investor this is REALLY confusing. So I have created this dummies guide to equity to really give you a base level understanding of exactly what equity is.

Here are the major things we will be looking at

- What is equity?

- Why even use the term equity?

- How do you access equity?

- The two ways to get equity

- What is “available equity” or “useable equity”?

- Do you pay tax when accessing equity?

What Is Equity?

I could put a technical definition in here but I think we can make it simpler than than. While this explanation may not be 100% technically accurate it will help give you a better understanding of equity.

Equity is the part of your property you don’t owe the bank money for.

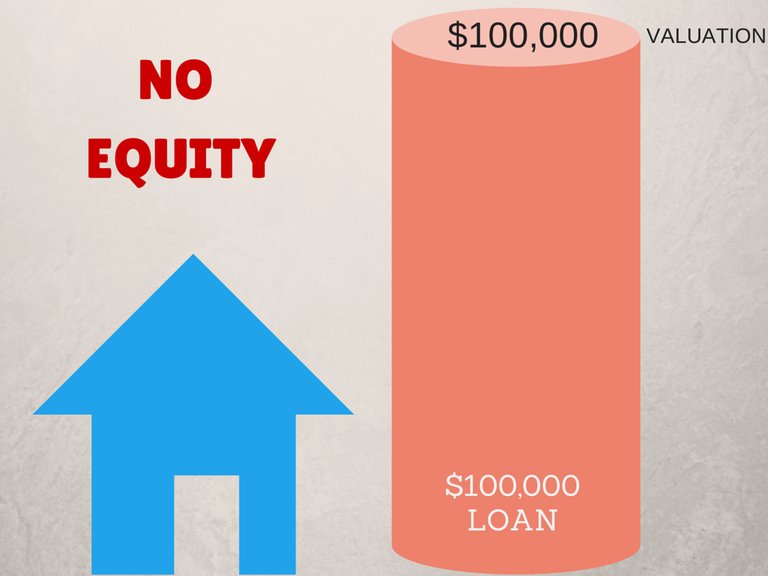

No Equity Example

It’s easiest if we first look at a property with NO equity at all. Below is an image of a $100,000 property with a $100,000 loan attached to it.

Because you owe 100% of the value of the property ($100,000) to the bank then you have no equity.

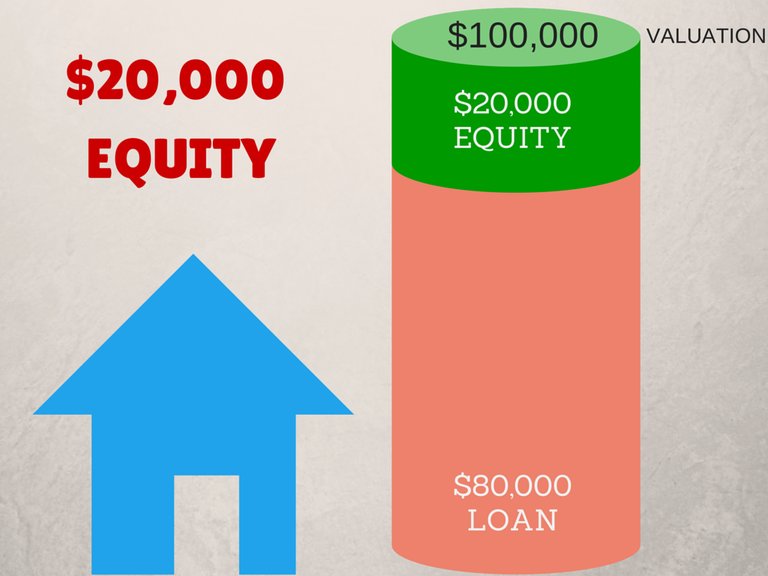

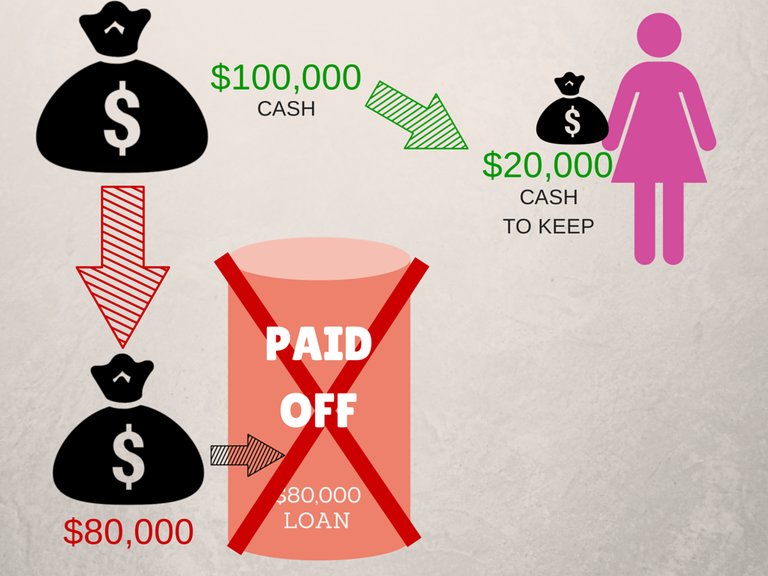

$20,000 Equity Example

Now let’s say our great aunt dies and leaves us $20,000 and we put that money onto the loan of our property.

The below example shows that our loan is now only $80,000 because we paid off $20,000.

This means there is $20,000 of value that we don’t owe the bank for. This is our equity.

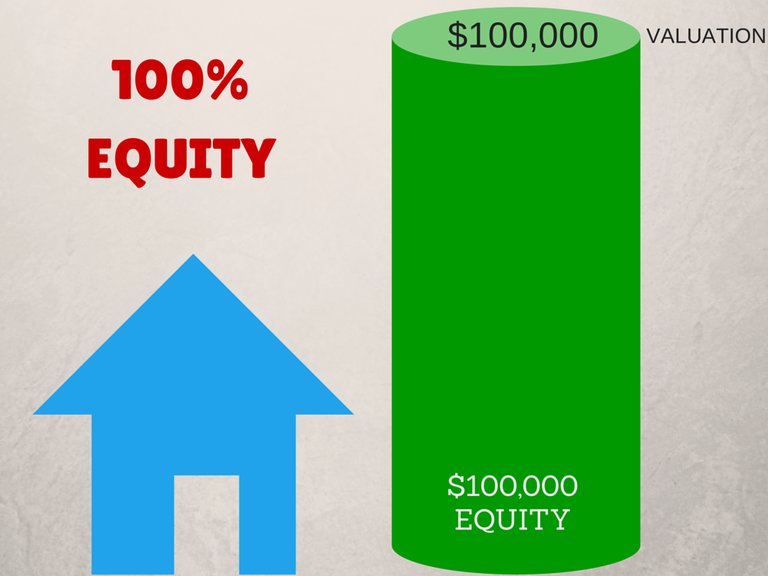

100% Equity

Now let’s imagine we are 20 years in the future and we have paid off our loan completely. We owe $0 to the bank.

We now have “full equity” or “100% equity” in the property. In this case we have $100,000 in equity.

Remember, equity is any value where we don’t owe the bank money for that value. Because we don’t owe the bank anything the full $100,000 is our equity.

Why Use The Term Equity At All?

It’s important to understand that equity is a “mental concept” and never ACTUALLY exists in a physical way that you can see and touch.

You rarely hear people talking about equity when investing in stocks. So why talk about it when investing in property?

Stocks – People mainly use their own money to buy stocks

Property – People mainly use the banks money to buy property

Because investors want to get access to more money without selling, and because banks and lenders want to create more loans the concept of equity was invented.

The concept of equity serves two major functions

1. As an investor is allows you to access money as your property grows in value.

2. For lenders ‘equity’ gives them security for their loans.

If this doesn’t make sense yet don’t worry I will explain that in more detail below.

How Do You Access Equity?

Equity is the IDEA that your property is worth $X more than what you owe the bank

In order to access “equity” you must first turn it into something real. There are two ways to do this

1. Sell your property

When it is just “equity” it isn’t real cash. It is just a “mental concept” that our property is worth $X more than what we owe the bank.

When you sell your property you receive cash. This effectively turns the FULL VALUE of the property into REAL CASH.

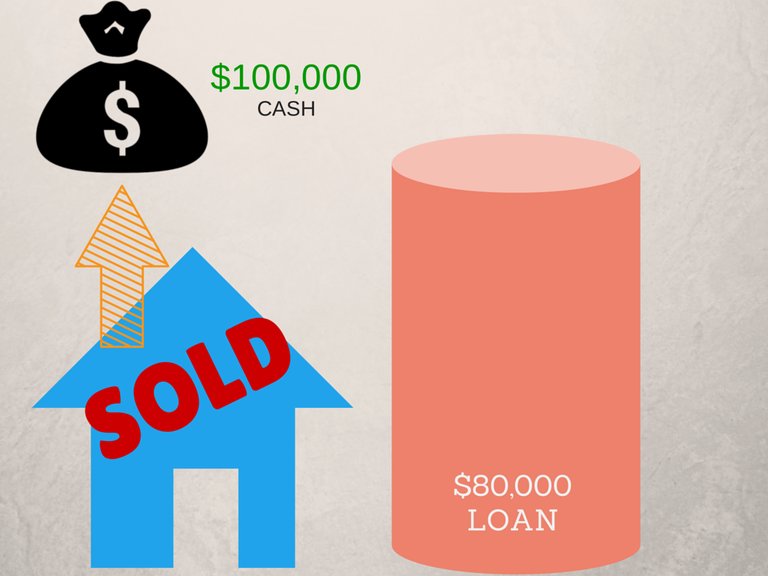

In the example below we owed the bank $80,000 and we had $20,000 in equity.

We then sold our house and received $100,000 in cold card cash. But we still owed the bank $80,000.

We then give the bank their $80,000 and we get to keep the $20,000. This equity is now real cash.

We get to keep the $20,000 cash that used to be called “equity”

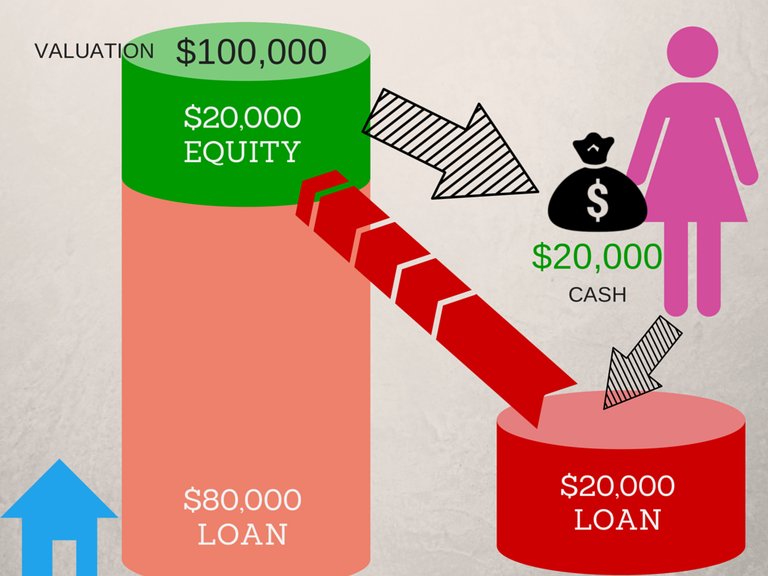

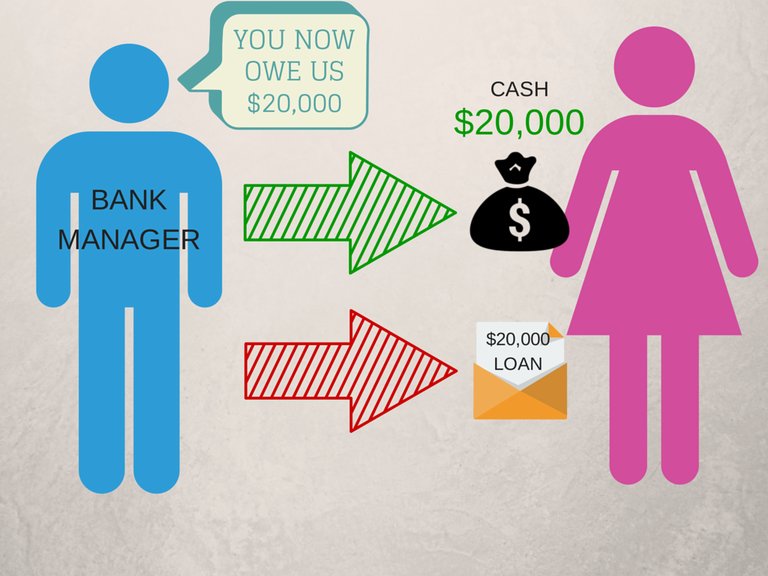

2. Create A Loan

The other way we can turn this “mental concept” of equity into something tangible is to create a bank loan.

People call this “accessing equity” but what they REALLY MEAN is “getting a new bank loan”.

The only reason they call it this is because the bank is using the “increased value” or “equity” to act as SECURITY on the loan.

Aka. Banks don’t give out loans willy nilly. They want to know that if you default and they have to sell the house they will get their money back.

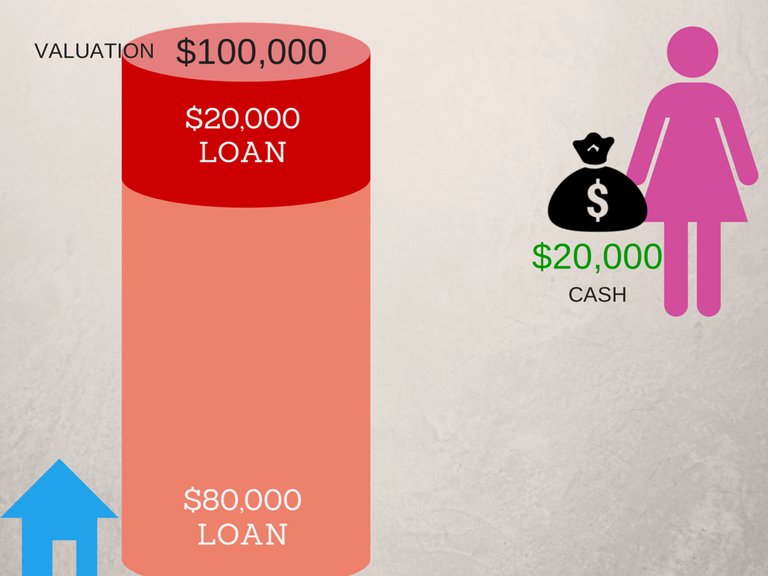

So in the example below we owed the bank $80,000 and we had $20,000 in equity.

- We receive $20,000 FROM THE BANK in cash

- We have A NEW LOAN for the same value ($20,000)

- Our total mortgage is now $100,000

So we didn’t actually “access the equity” we created a new loan.

We now have $20,000 in cash but we have a $100,000 loan ($80,000 + $20,000)

It’s Like A Personal Loan

It’s the same as going to the bank and saying “I’de like a $20,000 personal loan” and they give you $20,000.

Yes you get $20,000 cash, but now you owe $20,000 to the bank. They cancel each other out…there is no gain.

The same is true for “equity loans”.

Even though people say they are “accessing equity” all they are doing is getting a new loan.

The only difference to a personal loan is that interest rates are lower because the bank believes if you default they can sell the house and get their money back.

DISCLAIMER No Legal, Financial & Taxation Advice

The Listener, Reader or Viewer acknowledges and agrees that:

- Any information provided by us is provided as general information and for general information purposes only;

- We have not taken the Listener, Reader or Viewers personal and financial circumstances into account when providing information;

- We must not and have not provided legal, financial or taxation advice to the Listener, Reader or Viewer;

- The information provided must be verified by the Listener, Reader or Viewer prior to the Listener, Reader or Viewer acting or relying on the information by an independent professional advisor including a legal, financial, taxation advisor and the Listener, Reader or Viewers accountant;

- The information may not be suitable or applicable to the Listener, Reader or Viewer's individual circumstances;

- We do not hold an Australian Financial Services Licence as defined by section 9 of the Corporations Act 2001 (Cth) and we are not authorised to provide financial services to the Listener, Reader or Viewer, and we have not provided financial services to the Listener, Reader or Viewer.

"This property investment strategy is so simple it actually works"

Want to achieve baseline financial freedom and security through investing in property? Want a low risk, straightforward way to do it? Join more than 20,000 investors who have transformed the way they invest in property."