Short Term vs Long Term Rentals – A New Kind of Positive Cash Flow

In the past it used to be that short-term rentals were for people who own vacation homes and wanted to make a little bit of extra money from owning them.

But now with the introduction and the growth of places like Airbnb there’s potential that you could make more rental income per year renting your property out short term then you could renting your property out to a long-term tenant.

Today’s episode is made in partnership with Made Comfy who offer professional Airbnb management services.

A Growing Trend

I’ve had a lot of people in my life starting to do this, I’ve got friends who are now renting out their properties through Airbnb. I know people who rent out extra rooms through Airbnb.

I’ve got friends of my dads who live in Sydney and they purchased a property in Tasmania that was a dual income property. They’re renting out both sides of the property through Airbnb and using a property manager and I think they were getting upwards of around 13% rental yield for that property.

It has been so successful they were considering selling their Sydney property and buying a couple more properties in Tasmania to replicate the same strategy and become financially free.

Short-term rentals may be a new way to make a property positive cash flow

In this article I want to explore some of the pros and cons and considerations that you need to have if you’re considering a short-term rental for your property.

Do Short Terms Rentals Make More Money Than Long Term Rentals?

The first thing we need to consider is the money and whether or not you can actually make more money through short-term rentals than long.

I feel like if you can’t make more money then it’s going to be a lot more hassle for less money and that doesn’t seem worth it.

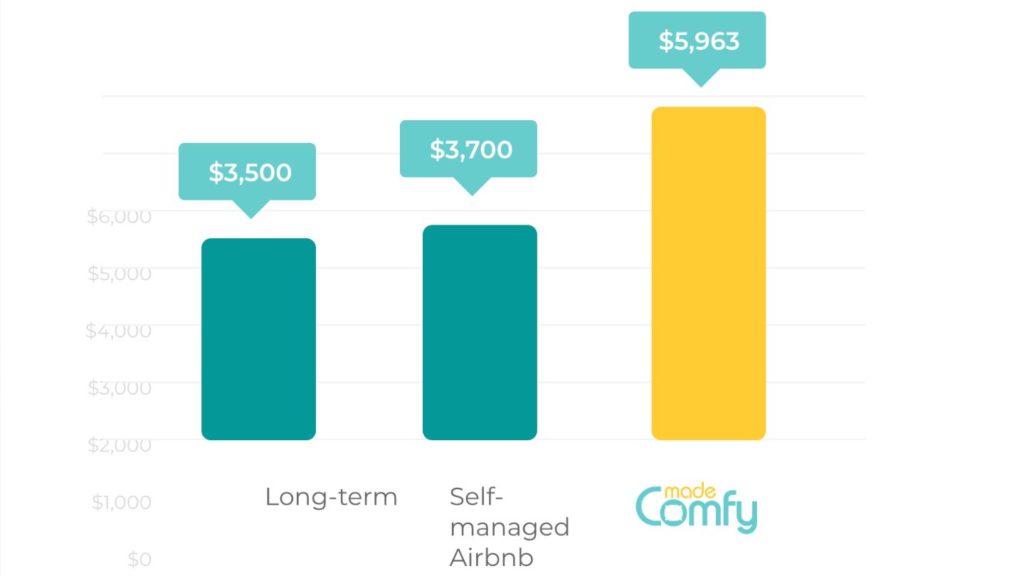

If we have a look at the average monthly returns based on a two-bedroom apartment in Darlinghurst you can see that for long-term rental you’re looking at around $3,500 per month. Self-managed Airbnb a bit higher and then using a professional property management service like Made Comfy that could even go upwards of $5,900

There clearly is the opportunity to make more money and it’s not just Made Comfy that are talking about this either.

This article at The Courier Mail talking about Airbnb listings generating much more than pocket money. There’s this article on Property Update talking about the Airbnb phenomenon and short term rentals then you’ve got this article talking about the most profitable Airbnb locations. Then we’ve got a forum post where people are talking about Airbnb and saying that “on average the returns are higher than a normal rental.”

It definitely seems like there’s potential to make more money through short term rentals.

Short Term Rental Case Studies

Let’s have a look at some case studies here from Made Comfy’s site

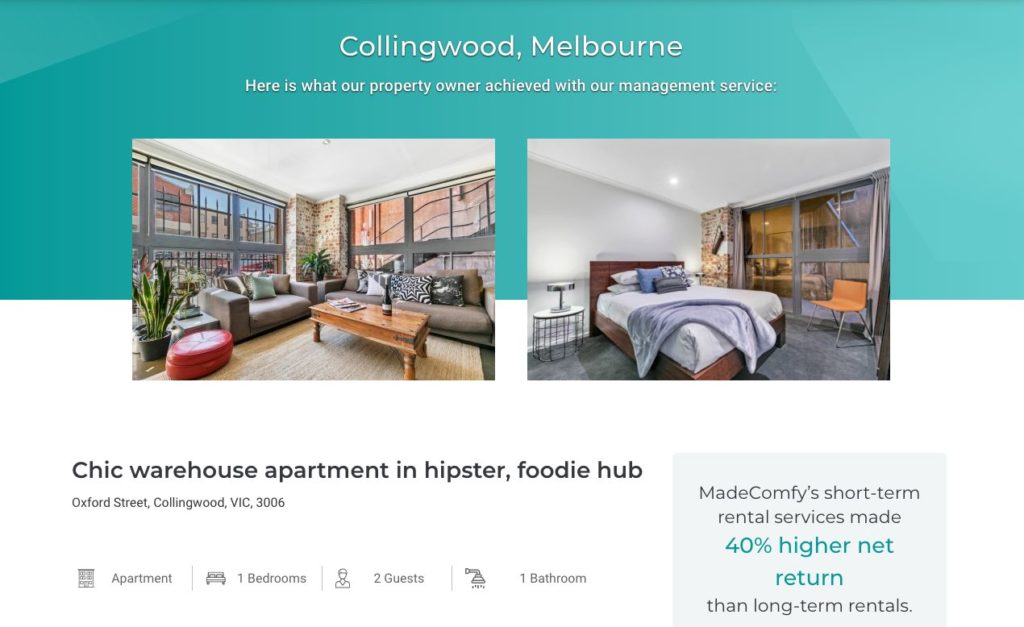

Collingwood, MEL

For the Collingwood one you can see that they actually boosted their rental income by moving to a short term rental. They get a 40% higher net return than a long-term rentals.

That word NET RETURN is actually really important because gross return is how much total income that you’re bringing in and net return is actually your return after expenses.

So 40% higher net return, not just a 40% higher gross return.

One of the I guess cons of short-term rentals is that they are more expensive to manage, you need to furnish them as well and you need to clean them so there’s a lot more management and maintenance required that cost more money.

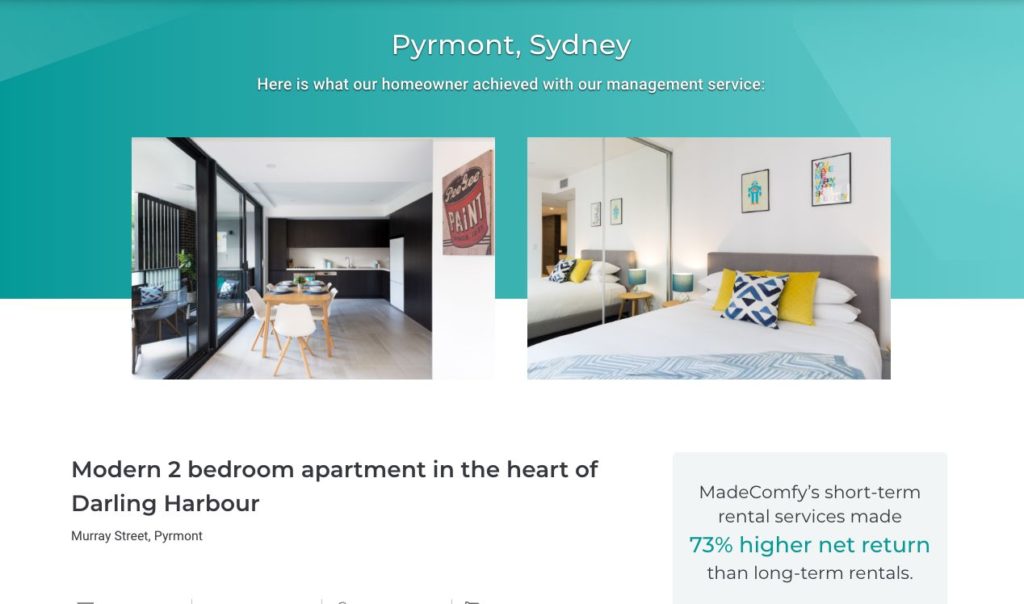

Pyrmont, SYD

If we look at the one in Pyrmont in Sydney, we can see a 73% higher net return.

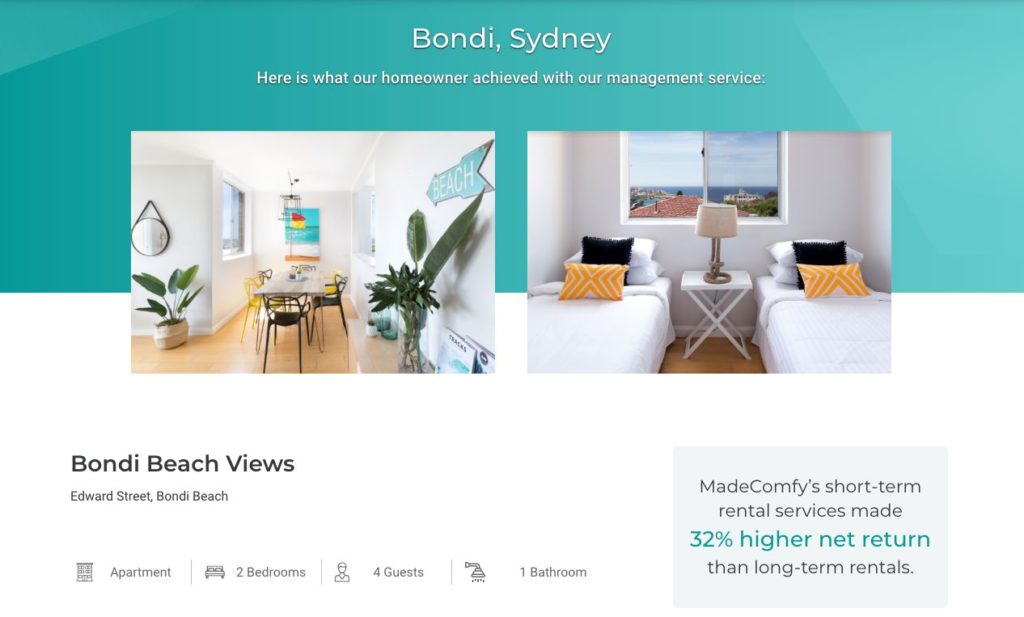

Bondi, SYD

If we look at the one in Bondi that’s 32% higher

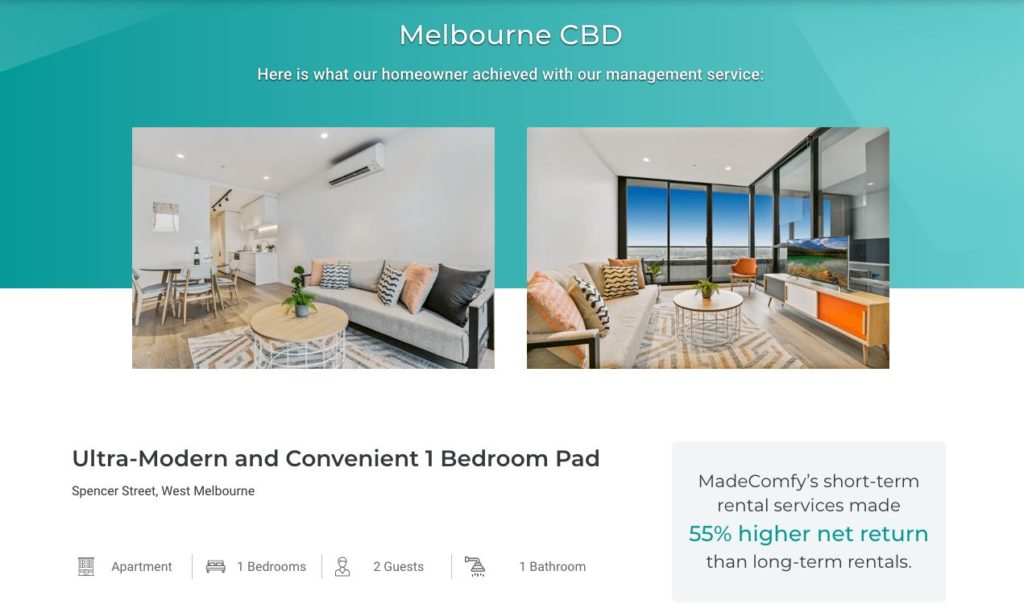

West Melbourne, MEL

If we look at the one in where was this West Melbourne 55% higher

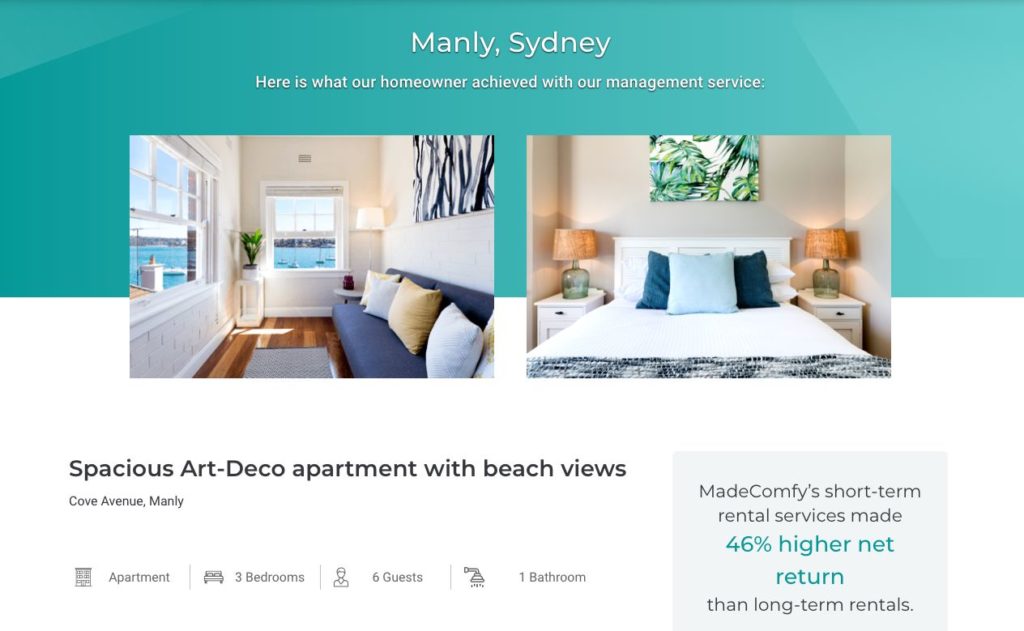

Manly, SYD

Lastly let’s look at the one in Manly that was 46% higher.

These examples aren’t 3% higher, 2% higher or 1% higher. These are actually significant boosts in the rental income

If you’re looking at weekly rent the Manly example might have got $990/week just renting out their property long term.

But short-term they’re getting over $1,400 weekly rent in terms of Airbnb.

That’s a huge boost (like massive) and that could potentially turn a property from a negatively geared property that’s just eating away at your cash flow to a positively geared property.

It’s potentially possible that you could buy properties in Sydney, in Melbourne or in Brisbane and use this short-term strategy to actually get a positive cash flow return from your properties.

This would allow you to pay off your mortgage faster and achieve financial freedom faster. You can see why I’m so excited to talk about this

The Pros and Cons of Short-Term Rentals

Let’s have a look at some of the pros and cons of short versus long term rental because it’s not like

“Let’s rent out our property short-term and it’s going to be this magic money-making machine”

There are some pros and cons to it:

Pro #1: Potential For More Rental Income

Obviously we talked about the potential for more rental income for the property.

I think that is obviously the most important one and why people would actually be pursuing this is to get more rental income and get positive cash flow.

Pro #2: You Can Holiday There Yourself

You also have got the opportunity to stay there yourself at any time when your property is empty.

You can go and enjoy it yourself

Pro #3: You Can Convert It To Long-Term Any Time

You can convert it to long term rentals at any time as well so you’ve got some flexibility there.

Pro #4: Depreciation

We will talking one of the cons about the need to furnish the property but that actually gives you a pro which is the potential for depreciation.

Talk to your tax specialist about that but if you’re furnishing the property and that furniture is decreasing in value over time through usage and through wear and tear you may actually be able to depreciate that giving you some tax benefits.

Pro #5: Easier To Keep Up With Repairs

There another pro is that it’s also easier to keep up with repairs. Because you’ve got people coming in and you’ve got people going out there’s times when it’s vacant where you can actually repair things that are broken.

Pro #6: Less Overall Wear and Tear

It can also lead to less wear and tear on your property as well because it’s not vacant as long people aren’t living there.

Also you’re getting cleaning services so someone’s coming in to professionally clean that property every time someone leaves. So the property is getting cleaned way more effectively and way more frequently than a would it for a long term property and so that can just help to keep the property in a better condition for a longer period of time.

There’s a few benefits there there’s also a few negatives as well:

Con #1: Unpredictable Income

The first negative that I see is the unpredictability of the income.

Let’s say you’re renting a property on the Sunshine Coast. The Sunshine Coast is going to be more popular in tourist season – school holidays, over the Christmas period etc – there’s going to be a lot more tourist activity in the area and therefore you can charge more money during those time periods and likely have the properties booked out more during those time periods.

Then you have time periods like winter where not many people are going up there because it’s not quite warm enough for the beach and you have to charge less and your property may be vacant more.

You might have a period where you’ve got not much income coming in at all and then you’ve got a period where you’ve got heaps of income coming in.

That unpredictability of income could definitely be a negative. You need to manage that over the year and if you haven’t done Airbnb before I can see that that would make some people nervous.

Con #2: Short-Term Rentals Take More Work

Another negative is that short-term rentals are obviously more work than long-term rentals.

You can do it yourself you can manage your Airbnb yourself but obviously there’s going to be a lot of work in doing that – responding to people’s requests, dealing with issues, people checking in and checking out – all of that sort of stuff.

You can do it yourself but it’s a lot more work.

Con #3: Property Management Fees Are More Expensive

Because of the extra work that’s required the management fees do tend to be higher for short-term rentals.

For a long-term rental there might be somewhere around the 7-9% mark in management fees. For a short-term rental you’re probably looking more around the 15-20% percent mark for a rental manager to manage that property for you.

So you need to make sure that you’re getting enough boost in rental income that it covers those extra expenses

Con #4: Expense of Furnishing The Property

You’ve also got the extra expense of furnishing your property as well.

If someone’s coming to an Airbnb they’re going to expect couches and beds and tables and stuff in the kitchen. They will expect nice stuff as well. They’re not going to expect it to be dodgy couches from Vinny’s or a mattress that you picked up on the side of the road.

You do need to have style and you do need to buy good things and that comes at an expense.

Con #5: Cleaning Costs

You’ve also got cleaning costs but that’s generally covered by the person that stays at your property and you just add that into the fee. But that’s something that you’ll need to pay for or get them to pay for.

Con #6: Short-Term Rentals Don’t Work in Every Market

Another consideration is that short term rentals don’t work in every market.

The properties that we looked at here are all kind of inner city or beaches. These areas that are in a city that are the beaches in big cities are going to be more in demand for Airbnb than other areas.

If you’re out in the sticks somewhere where there’s not really much tourism or not many people actually looking for short-term rentals then this strategy might not work for you.

But there are a lot of areas that it can work in but definitely different suburbs within those areas are going to perform better than others.

If you’re right in the CBD or if you have ocean views you’re obviously going to be able to command a higher rate than your if you’re out in the western suburbs of Sydney for example where it’s less touristy.

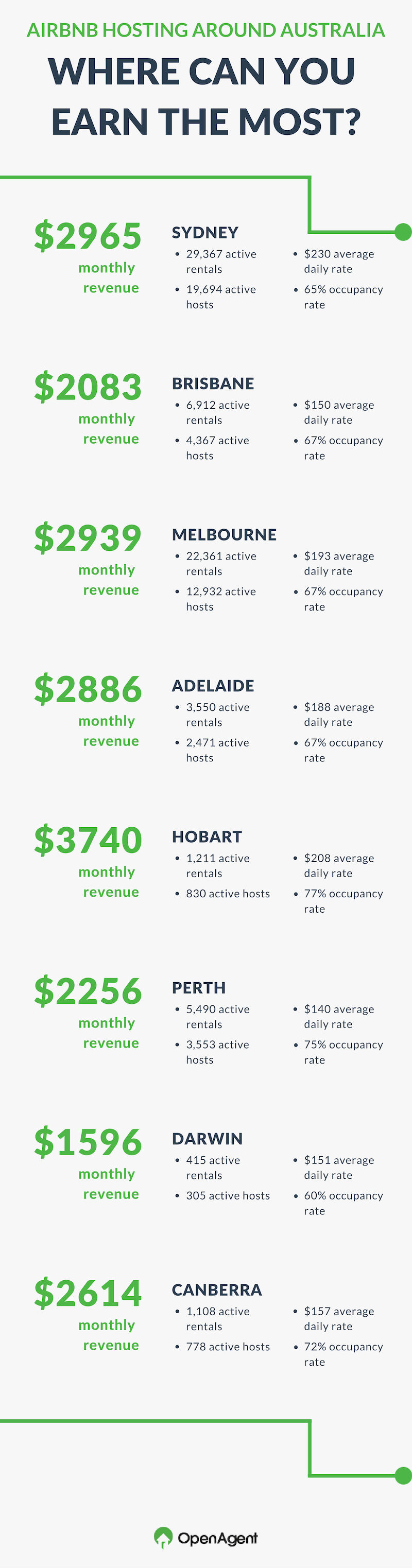

Short-term rentals may not work in every single area but by the looks of this infographic it definitely can work in most major cities.

Made Comfy have put out a report on the short-term rental market in Queensland. Click the link and download this report and have a look at it yourself and to see okay where are the areas what are the states and what are the suburbs that are performing the best.

Looking at Brisbane and the number of nights booked I can see it going up over time but what is really interesting is looking at the long-term gross is for an area and then looking at if you’re doing Airbnb you can just see how much significantly higher the income is.

Click here to download the full report with all the data

If we look at the Gold Coast we can see that there is a big jump in short term rental income in a lot of suburbs.

Somewhere like Burleigh Heads – long-term rental income is around $15-$16,000/year and then you can see Airbnb market gross of around $23,000/year.

Surfers Paradise which is obviously the biggest destination spot on the Gold Coast long term really similar to Burleigh around $16,000/year but then short-term Burleigh was around $23,000 and Surfers Paradise is around $30,000!

So as you can see some areas will do better than others but as you can see it could potentially work in lots of different areas but some areas will work better than others.

They then go on in this report to talk about short term rental pricing strategy and how to maximize your rental return so that’s really interesting if this is something you’re considering again download the full report here.

Con #7: It’s Not Easy To Furnish Your Property Well

It’s not easy to furnish the property correctly. You do need to furnish it well and you can’t just put in expensive furniture you’ve got to put in furniture that feels really nice and looks really good .

If I got someone like Kelly to do it she would do an amazing job, or Ben’s wife Lisa is an interior designer she would do an amazing job but if I tried to furnish it myself I probably wouldn’t do an amazing job.

My house is alright but you can tell that I don’t have that eye for interior design.

You can hire people out there to help you with that but you want to get a right and that’s definitely going to change how much rental income you get.

Con #8: You Need Professional Photos

The same is true with professional photos for your Airbnb listing as well. You want to get that right so you property looks desirable and people want to rent it

When done correctly, some properties are renting out months in advance at these short-term prices and so they’re doing really well.

Other Considerations

There are some final things to consider before starting to rent out your property short-term:

Insurance

You’re going to need the right type of insurance which is going to be different from long term rentals.

Issues With Neighbours

You also need to consider issues with neighbours as well.

I did rent a place down in Melbourne and the lady who was our host was saying that sometimes people in the building get annoyed that she’s renting it out through Airbnb and the strata gets annoyed at her. But ultimately she’s allowed to do that and so bad luck to them.

Issues with neighbors issues with strata if you’re in a unit block could also be something as well because obviously if you’ve got Airbnb people staying they’re more likely to stay out late and they’re more likely to be louder.

Are Short-Term Rentals Worth Exploring For You?

I think we can see from all of this that there’s definitely potential to make more money with short-term rentals than long-term rentals.

This is still a new concept and something that is yet to be tested by a lot of different people.

However, if you have a property that you’re renting out and you’re not happy with the cash flow of that property if you want to be able to convert that and maybe even push that into a positive cash flow position then this is definitely something worth looking into more and something worth exploring.

I’ll have more episodes coming out in the future related to this topic because I think moving into 2020 and beyond this is definitely something that’s going to be a growing trend and not something that’s going away.

If it can help you get to financial freedom faster and help you get positive cash flow then that’s definitely worth looking into.

A big thank you to Make Comfy for sponsoring this episode and making this possible.

I hope you found this interesting I’m super excited to explore this in more detail in the future.

DISCLAIMER No Legal, Financial & Taxation Advice

The Listener, Reader or Viewer acknowledges and agrees that:

- Any information provided by us is provided as general information and for general information purposes only;

- We have not taken the Listener, Reader or Viewers personal and financial circumstances into account when providing information;

- We must not and have not provided legal, financial or taxation advice to the Listener, Reader or Viewer;

- The information provided must be verified by the Listener, Reader or Viewer prior to the Listener, Reader or Viewer acting or relying on the information by an independent professional advisor including a legal, financial, taxation advisor and the Listener, Reader or Viewers accountant;

- The information may not be suitable or applicable to the Listener, Reader or Viewer's individual circumstances;

- We do not hold an Australian Financial Services Licence as defined by section 9 of the Corporations Act 2001 (Cth) and we are not authorised to provide financial services to the Listener, Reader or Viewer, and we have not provided financial services to the Listener, Reader or Viewer.

"This property investment strategy is so simple it actually works"

Want to achieve baseline financial freedom and security through investing in property? Want a low risk, straightforward way to do it? Join more than 20,000 investors who have transformed the way they invest in property."