15 Tips For Buying Multiple Investment Properties

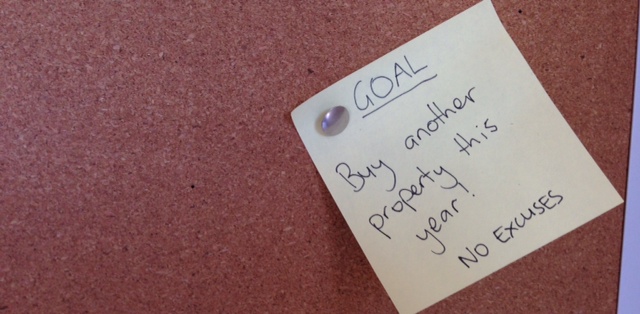

Buying multiple investment properties and growing a large property portfolio is something that few Australian every achieve.

But for those who do buy multiple investment properties they find themselves substantially better off than the rest of the population.

Owning a large portfolio of properties means you get to take advantage of capital growth across a variety of assets and you get to use the power of leverage to grow a small investment into a substantial one.

It is very difficult to achieve financial freedom from just one investment property, but once you own multiple investment properties financial freedom becomes extremely achievable.

Below I have 15 tips to help you amass a large property portfolio:

1. Buy below market value

There is an old saying that says “you make your money when you buy”. For most investors this isn’t true because they are buying property at market value and simply crossing their fingers hoping for the market to go up.

By doing your research you can locate properties all over Australia which you can buy for under market value.

Maybe the property has been on the market too long, or maybe the seller needs some quick cash for personal reasons.

But every now and then properties sell well below their market value. It takes a lot of research, and you might have to make 100 low ball offers before you get one accepted.

But if you can buy below market value you have instant equity which you can then use to reinvest and buy even more investment properties.

2. Add value through renovation

Renovation can be a great way to add value to a property and gain equity quickly.

Most people shop with their emotions, not with their imaginations.

Very few people look at a run down property and see its potential. Thus run down properties often fetch for well below market value of similar well kept properties because people don’t want to put in the work to bring them up to speed.

If you are willing to put in the effort and you are smart with your renovations (avoid homes in need of a lot of structural work) you could add a great deal of equity to your property fairly quickly.

3. Buy at the right time in the property cycle

Many investors like to refer to “The property clock”.

When they are talking about the property clock they are talking about the difference between a market that is declining and a market that is booming.

By purchasing a property in a market that has hit the bottom and seems to be rising you can take advantage of quick capital gains on the property.

However, if you get swept away and end up buying a property at the height of the boom you could find yourself waiting years and years before the property is worth even what you paid for it.

As you are likely going to need to borrow against equity gained in your properties to continue investing, you probably don’t want to buy property that isn’t going to grow in value within a short-medium time frame.

Buy incorrectly and you will run out of equity and you won’t be able to invest any further.

4. Constantly get property values reviewed

A lot of investors who own just one property fail to get their property revalued.

If your property has gone up in value it is probably worth paying to get a valuation done. If the property has a higher valuation that previously this means you now have access to more equity for investing.

Property valuations do cost money but they are often tax deductible. If the market it booming and you believe your property has gone up in value why not get it revalued?

5. Do not cross-collateralise

Many professional investors warn against cross-collateralisation.

This is where you secure your loan against 2 or more properties instead of just the one property.

If you have 2 loans with one bank it is highly likely that your loans are cross-collateralised by default.

The only real way to avoid this is to use a new lender for every single property you purchase.

The reason this is dangerous is two fold:

A) If your property falls in value they can force you to sell multiple properties (often your home) in order to pay off the debt

B) If you sell your property to access the capital gains the lender may (without consulting you) use some of the profits to pay down your debt on other loans.

This means money you would have had to invest has now automatically gone to paying down a mortgage.

Cross-collateralisation can really put the brakes on a growing property portfolio by not allowing you to use your money as you see fit.

6. Get a great mortgage broker

Obtaining finance is much harder than it was 10 years ago and it isn’t about to get much easier.

Having a great mortgage broker will help you to maximise your borrowing capacity and will allow you to get approved for more (and better) loans, allowing you to grow your portfolio faster.

As you become a serious property investor it may be worth creating a relationship with the banks, however in the early days it is almost always better to work closely with a trusted mortgage broker.

7. Get good at researching the market

If you are buying multiple investment properties you probably aren’t going to want to buy every single property in your street.

You are probably going to want to invest in different suburbs and maybe even different states.

It is important that you train yourself how to analyse and research a suburb or town effectively so you know what to look out for.

You want to avoid getting stung by buying in the wrong area. We have an entire training module dedicated to teaching you this click here to see our Advanced Suburb Research course.

8. Keep abreast of trends and changes

Governments are constantly changing and updating laws and taxation and this can have huge implications on your property investments.

Stay abreast of changes that affect property investing as a whole (eg. Interest rate changes, taxation changes) and also changes that affect the areas you are invested in (council upgrades, bipasses etc)

For example, if you own a property in a mining town and the government does a huge land release in the area this is going to drastically affect supply and demand and could lower the value of your property.

9. Create positive cash flow where possible

Positive cash flow occurs when your investment income (usually rental income) is greater than the sum of all your expenses.

If every property you buy is putting extra cash flow into your pocket then you can afford to service these properties and continue expanding.

But if every property takes money out of your pocket every week because it is negatively geared then you will soon find yourself without enough money to keep the properties afloat, let alone keep investing.

By having positive cash flow properties you are free to reinvest the extra cash flow or you can use it to fund the increasing expenses that come with obtaining equity loans to buy more properties.

10. Take great care of your tenants

Your tenants are your #1 asset so take great care of them.

Without tenants paying you rent every week it is highly likely that your property portfolio will come crashing to the ground.

I am not advising you to never increase rents (truthfully I think steadily increasing rents is a wise investment decision for many investors) but I am saying to take good care of your tenants.

When they ask for something to be fixed it is generally not a bad idea to get on it straight away.

If you have tenants that pay on time all the time why not find ways to surprise them and make them love their landlord.

Some free movie tickets or a free bottle of wine go a long way to keeping happy tenants happy.

11. Don’t make emotional decisions

Most people purchase property emotionally. They love the look or the feel of the property and thus they are emotionally motivated to pay more than what the property is worth.

By keeping a level head and always doing the numbers you can avoid these emotional decisions and can continue to buy properties below market value, or at least properties with solid growth potential.

One of the last things you want as an investor is to buy a property because you liked the look of it only to find out it is consistently losing you money with no hope of making it back any time soon.

12. Make lots of offers

Don’t be afraid to make lot of offers on properties. You might have to make 100 offers to get one seller accept an offer that you are happy with.

But that is better than making very few offers and paying a great deal more than what you should have paid for the property.

If you are going to present a low-ball offer always try to justify the price.

Talk about the need for renovation or the structural concerns or the state of the suburb. By justifying your offer it is more likely to be considered and won’t simply offend the seller.

13. Take advantage of 95% loans if viable

If it’s viable for you consider paying Lender’s Mortgage Insurance in order to get a 95% loan. This allows you to invest with a smaller deposit and stretch more money further.

It could mean the difference between you buying one more investment property or being stuck with the portfolio you currently have without being able to grow.

14. Keep interest only loans

Many professionals advise investors to use interest only loans. T

he rationale is that they maximise tax deductions by keeping your interest repayments at the same amount and they maximise cash flow because you aren’t using cash flow to pay down your mortgage.

The cash flow benefit could mean the difference between a positive cash flow property and a negatively geared property and it could improve your serviceability with the lenders as well.

15. Sell To Expand

Buying multiple investment properties doesn’t mean you have to buy properties and never sell them.

Sometimes it makes sense to sell a property that is underperforming, realise the capital growth and equity and use that money to reinvest in another property (or two) that are likely to perform better.

Don’t get stuck with a dud hoping that one day it will be worth more money. If the negative signs are there consider selling it and use the money to buy something with a better rate of return.

Buying Multiple Investment Properties Isn’t Easy, But It Doesn’t Have To Be Hard

Buying multiple rental properties doesn’t have to be hard. It is very much a “rinse and repeat” process.

The first property is always going to be the hardest and then after that your experience grows and purchasing more properties begins to become easier.

It is a process and it is not something you will achieve overnight, but it is a great goal and a very achievable goal if you continue to work at it.

If you want to learn how to find positive cash flow properties all over Australia then check out the course on How To Find Positive Cash Flow Properties.

Listen To The Podcast Episode

DISCLAIMER No Legal, Financial & Taxation Advice

The Listener, Reader or Viewer acknowledges and agrees that:

- Any information provided by us is provided as general information and for general information purposes only;

- We have not taken the Listener, Reader or Viewers personal and financial circumstances into account when providing information;

- We must not and have not provided legal, financial or taxation advice to the Listener, Reader or Viewer;

- The information provided must be verified by the Listener, Reader or Viewer prior to the Listener, Reader or Viewer acting or relying on the information by an independent professional advisor including a legal, financial, taxation advisor and the Listener, Reader or Viewers accountant;

- The information may not be suitable or applicable to the Listener, Reader or Viewer's individual circumstances;

- We do not hold an Australian Financial Services Licence as defined by section 9 of the Corporations Act 2001 (Cth) and we are not authorised to provide financial services to the Listener, Reader or Viewer, and we have not provided financial services to the Listener, Reader or Viewer.

"This property investment strategy is so simple it actually works"

Want to achieve baseline financial freedom and security through investing in property? Want a low risk, straightforward way to do it? Join more than 20,000 investors who have transformed the way they invest in property."